Starting a food business is a complex and multifaceted endeavor, requiring meticulous planning and financial foresight. The initial budgeting and start-up costs are crucial elements in this process, as they set the foundation for the business’s financial health and operational success. This section delves into the key components of initial budgeting and start-up costs, offering guidance on how to estimate and manage these expenses effectively.

1. Understanding Initial Budgeting

1.1 The Purpose of Initial Budgeting

Initial budgeting involves creating a financial plan that outlines the estimated costs required to start and launch a food business. It serves multiple purposes:

- Financial Clarity: Provides a clear picture of the funds needed to initiate the business, helping to secure financing and manage cash flow.

- Operational Planning: Aids in planning the operational setup, ensuring that essential resources and equipment are in place before opening.

- Risk Management: Helps identify potential financial gaps and risks, allowing for proactive measures to mitigate these issues.

1.2 Components of Initial Budgeting

a. Fixed Costs

Fixed costs are expenses that do not vary with the level of production or sales. They include:

- Lease or Rent: The cost of leasing commercial space for the kitchen, dining area, or production facility. Lease agreements should account for location, space requirements, and duration.

- Renovations and Remodeling: Expenses related to modifying the leased space to meet operational needs, including kitchen setup, dining area arrangement, and compliance with health and safety standards.

b. Variable Costs

Variable costs fluctuate based on the level of business activity and include:

- Equipment and Fixtures: Costs for purchasing kitchen appliances, cooking tools, refrigeration units, and dining furniture. Invest in high-quality equipment to ensure efficiency and durability.

- Initial Inventory: Expenses for stocking the kitchen with food ingredients, packaging materials, and other consumables. Proper inventory management is crucial for maintaining operational flow.

c. One-Time Costs

One-time costs are initial expenses that do not recur regularly:

- Licenses and Permits: Fees for obtaining necessary licenses and permits, such as food handling permits, business licenses, and health certifications. Compliance with legal requirements is essential for operating legally.

- Branding and Marketing: Initial investments in branding, including logo design, website development, and promotional materials. Effective marketing strategies are vital for attracting customers and establishing brand identity.

d. Working Capital

Working capital is the funds needed to cover day-to-day operational expenses until the business becomes self-sustaining:

- Salaries and Wages: Costs for hiring staff, including chefs, servers, and administrative personnel. Budget for employee salaries, benefits, and training.

- Utilities: Expenses for electricity, water, gas, and other essential services. Consider energy-efficient solutions to manage utility costs effectively.

- Operational Supplies: Costs for cleaning supplies, office supplies, and other consumables needed for daily operations.

2. Estimating Start-Up Costs

2.1 Research and Planning

Accurate estimation of start-up costs requires thorough research and planning:

- Obtain Quotes: Gather quotes from suppliers, contractors, and service providers for equipment, renovations, and other expenses.

- Benchmarking: Analyze the start-up costs of similar businesses in the industry to gauge realistic financial requirements.

- Contingency Fund: Allocate a contingency fund (typically 10-20% of the total budget) to cover unexpected expenses or cost overruns.

2.2 Creating a Detailed Budget Plan

A detailed budget plan should include:

- Cost Breakdown: Categorize costs into fixed, variable, and one-time expenses. Provide detailed estimates for each category.

- Timeline: Develop a timeline for incurring expenses and launching the business. Align budget allocations with key milestones, such as securing a lease, completing renovations, and launching marketing campaigns.

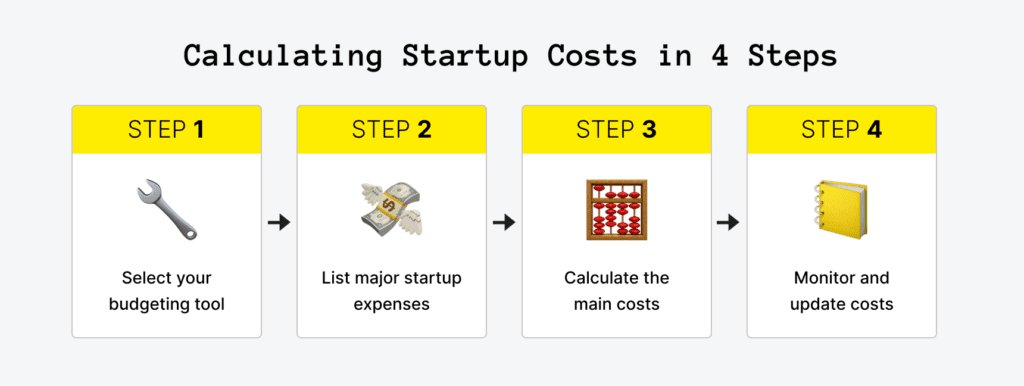

2.3 Monitoring and Adjusting the Budget

Regular monitoring and adjustment are critical for staying on track:

- Track Expenses: Keep accurate records of all expenses and compare them against the budgeted amounts.

- Adjustments: Make adjustments as needed based on actual spending and changes in business conditions. Update the budget to reflect any modifications or unforeseen expenses.

3. Securing Funding

3.1 Funding Options

Securing adequate funding is essential for covering start-up costs and supporting initial operations. Explore various funding options:

- Personal Savings: Using personal savings is a common way to fund start-up costs. It provides control over the business without incurring debt.

- Loans: Business loans from banks or financial institutions can provide additional funding. Prepare a solid business plan and financial projections to present to lenders.

- Investors: Seek investment from venture capitalists, angel investors, or family and friends. Investors may provide capital in exchange for equity or a share of profits.

- Grants and Competitions: Explore grants and competitions designed for food businesses. These can provide non-repayable funds or resources to support start-up efforts.

3.2 Developing a Business Plan

A well-developed business plan is crucial for securing funding:

- Executive Summary: Summarize the business concept, goals, and financial projections.

- Financial Projections: Include detailed financial projections, such as income statements, cash flow statements, and balance sheets.

- Funding Requirements: Specify the amount of funding required and how it will be used. Outline the planned use of funds and expected returns on investment.

4. Managing Start-Up Costs

4.1 Cost Control Strategies

Effective cost control strategies can help manage start-up costs:

- Negotiate with Vendors: Negotiate terms and prices with suppliers and contractors to reduce expenses.

- Prioritize Spending: Focus on essential expenses and defer non-critical costs until the business is established.

- Utilize Cost-Effective Solutions: Consider cost-effective alternatives, such as leasing equipment instead of purchasing or using digital marketing strategies over traditional advertising.

4.2 Record-Keeping and Documentation

Maintain accurate records and documentation for financial management:

- Expense Tracking: Use accounting software to track and categorize expenses. Regularly review financial reports to monitor spending.

- Documentation: Keep detailed records of all invoices, receipts, and contracts. Proper documentation supports transparency and facilitates financial audits.

Conclusion

Initial budgeting and start-up costs are foundational elements of financial planning for food businesses. By thoroughly estimating and managing these expenses, entrepreneurs can ensure a smooth launch and set the stage for long-term success. Careful planning, diligent research, and effective cost control are key to establishing a financially sound and operationally efficient food business. With a comprehensive understanding of start-up costs and funding options, food business owners can navigate the challenges of the start-up phase and build a strong foundation for future growth.